I requested a Google Wallet card recently. As you may know, this is Google’s second major push to get you to adopt their payment service which now operates both through a card and your Android phone. The first attempt focused heavily on paying by phone (aka tap-to-pay). That failed due to not enough capable terminals and carriers blocking the feature.

Now Google Wallet is back with what is essentially a debit card. Yes – the thing nobody online knows what to do with or why they need yet another card.

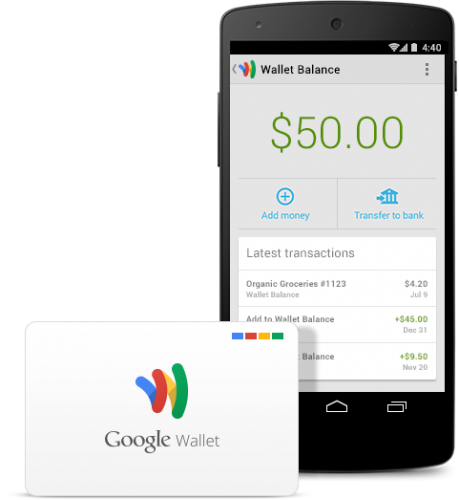

The Google Wallet Card is a debit card that lets you spend your Wallet Balance at millions of MasterCard® locations or withdraw at ATMs. Money is added to your Wallet Balance either by someone sending you money via Wallet or Gmail, or by adding it yourself from a linked bank account or from a credit/ debit card. The card has no fees to order and activate. There are no annual or monthly fees for the Google Wallet Card. Learn more about the Google Wallet Card.

I think I fit the profile of Google’s target user, and I’m pretty happy with Wallet.

Here’s where I think Wallet’s primary target market (for now) is:

- NOT actively using a debit card (though you can link cards I think this is one of the big indicators of whether you like wallet)

- Want to switch over to using debit more often

- Do not want to worry about bank account being hijacked (my GF Jen had hers compromised in the Target scandal).

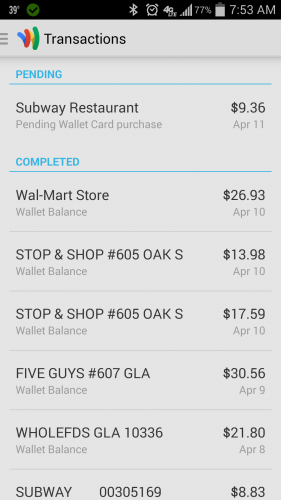

- Easy way to monitor transactions

I’ve been using my physical Google Wallet card quite a bit. Previously I had the tap-to-pay version which was great at CVS stores (the only place where I ever found a reliable terminal that would let me tap to pay).

Maybe the newness of a physical card will wear off. I like that immediately after using Google Wallet a receipt pops up on my Android phone.

Talk about easy to catch fraud. I review transactions anytime I like. Review balances by glancing at my phone.

By the time I’ve left the store I’m receiving an electronic receipt. At some point, save for infighting between competing payment providers, I see this as the way we all receive our receipts. I bet Google does too – and they would love to know your purchasing history.

The NFC portion of Google Wallet (aka tap-to-pay) won’t work for phones on carriers that are battling to introduce their own payment products (I believe that will be all of them). The Nexus 5 does support it.

My experience with touch-to-pay is sad and dismal.

The payment terminals that accept it often don’t work. And places you want to use tap to pay often don’t have a terminal. Nothing has changed here since Google started offering Google Wallet in 2011. Store clerks still look at you as if you’re on a day pass from the asylum when you try to use a phone to tap and pay at their checkout.

Google worked around the tap-to-pay flop by issuing what’s essentially a debit card that you fund by multiple sources. Until the end of April, they’ll let you fund it by a credit card (up to $250) without any fee (typically 2.9% since it’s really a cash advance). I resisted signing up for one of these free cards until recently, and I wish that I’d done it sooner.

Request a card by loading the Google Wallet app on your phone. From within the app there is a button to request that a card be sent. Mine arrived in less than 7 days. I’ve initially funded it from my credit card, though to avoid fees I’ll need to connect it to a bank account soon.

If you’re not using a debit card, and you’d like to carry less cash and pay by a system which notifies you of each transaction – Google Wallet is a great choice. In my view, the long game here is to convince a critical number of users to pay by Google Wallet and allow Google Wallet to capture electronic receipts. Armed with that data, Google would have a powerful tool to serve up even more promotional advertisements. Whether that’s something people want or not remains to be seen.

Good article. I have one too, but don’t find it convenient at all to have to load money to it. I thought it would be like the wallet app and be linked to your cards in wallet and just debit from the default acct.

Google Wallet does work on most android phones running Kitkat. The carriers, other than Sprint were blocking access to the secure element, but Google is now using HCE (host card emulation) to bypass the carriers trying to push their own tap to pay system (ISIS).

Unfortunately, I have a Galaxy note 3 on AT&T and it has an NFC chip that does not support HCE at this time without another update (which may never happen on AT&T.

This seems to be a solution to a problem I don’t have (both the physical card and tap to pay.) Credit cards work fine for me, and my bank’s debit card does as well. Credit cards also give me purchasing protection that debit cards lack.

My phone on Verizon supports tap to pay with Google wallet. I still don’t need it.